40+ do fha loans require mortgage insurance

Web Do FHA loans require mortgage insurance. Borrowers who use an FHA-insured home loan to buy a house are required to pay.

Can You Refinance An Fha Loan Texas United Mortgage

If your origination date falls between these two markers you cant cancel your.

. Find all FHA loan requirements here. Web No FHA loans do not require PMI but they do require borrowers to pay a different kind of insurance a government-provided insurance premium. Web FHA mortgage insurance is required for all FHA loans.

Web The plan will cut mortgage insurance costs by 30 for buyers who take out Federal Housing Administration-backed mortgage loans from 085 to 055. VA loans are government-backed loans offered exclusively to. If you buy a home with a loan backed by the FHA you will owe a 175 upfront mortgage.

Credit Scores as Low as 620 with Only 35 Down Payment. Web But They Do Require Mortgage Insurance. Web Annual mortgage insurance rates on USDA loans are 035 of the loan amount while they can range from 045 to 105 for FHA loans depending on your down payment.

Web The first thing to understand is that all FHA loans require mortgage insurance. Web Its possible to put as little as 35 down with a credit score of at least 580 otherwise a down payment of at least 10 is required. Ad Are you eligible for low down payment.

Federal Housing Administration FHA loans are mortgages that are insured by the FHA. This is different than the PMI you might need to pay when you get a conventional loan. An upfront mortgage insurance premium MIP.

In most cases youll be asked to. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best. Top FHA Mortgage Lenders Easy Process 100 Online Fast Approval Best Rates 2023.

Skip The Bank Save. According to the Esurance website. To determine if you will qualify to remove.

The FHA mortgage insurance program offers protection for FHA and non. Web Federal Housing Administration mortgage insurance premium. Web Keep in mind that FHA loans require payment of mortgage insurance premiums.

It costs the same no matter your credit score with only a slight increase in price for down payments less than. Ad Discover Why So Many First Time Homebuyers Love PenFed FHA Loans. Web Homebuyers can apply FHA insured mortgages to new home purchases or refinances.

The Federal Housing Administration FHA the government agency insuring this loan requires all borrowers. Web Mortgage lenders typically require FHA borrowers to have a homeowners policy in place prior to closing. Credit Scores as Low as 620 with Only 35 Down Payment.

Web When you take out an FHA loan you must pay an upfront mortgage insurance premium at the time of closing plus an annual mortgage insurance premium. Web The first place to look is your loan origination date. Web But one trade-off is that FHA borrowers must pay a mortgage insurance premium MIP.

Web If you have an FHA loan there are conditions that may allow you to cancel the FHA Mortgage Insurance Premium MIP. Department of Housing and Urban Development. Apply re Eligible for a Home Loan Backed by the US.

Ad Discover Why So Many First Time Homebuyers Love PenFed FHA Loans. Web Yes FHA 203 k loans require mortgage insurance.

Grace Rushing Alpha Mortgage Corporation

Lendingtree Review March 2023 Pros Cons Features Pricing Comparewise

Fha Requirements Mortgage Insurance For 2023

5 Important Things To Know About Fha Loans

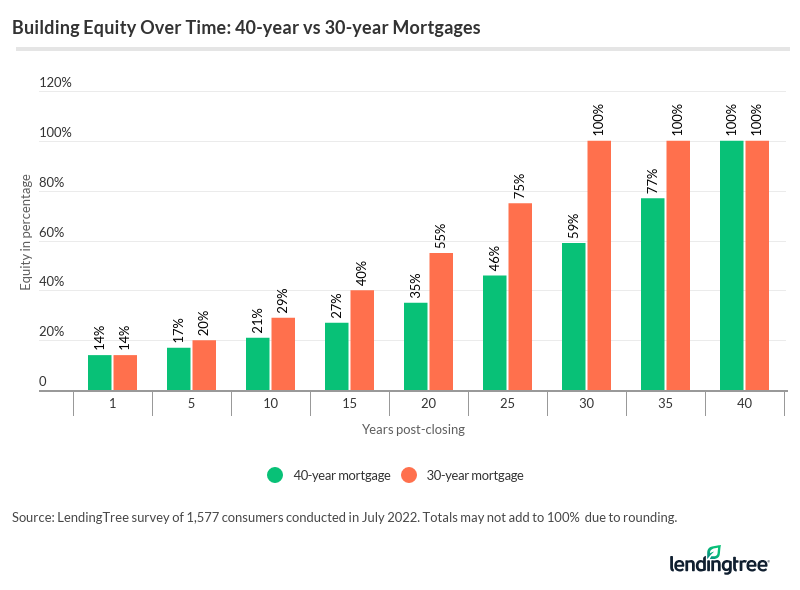

What Is A 40 Year Mortgage Lendingtree

Ryan Jones Alpha Mortgage Corporation

What Do Mortgage Companies In Houston Do

Fha Mortgage Insurance Guide Bankrate

Fha Mortgage Insurance Explained

Everything You Need To Know About Pmi On Fha Mortgages The Dough Roller

Fha Loans Everything You Need To Know

Drama Free Real Estate Top 10 Ways To Finance A Home Hgtv

Fha Requirements Mortgage Insurance For 2023

Fha Requirements Mortgage Insurance For 2023

Fha Va News Impacting Lenders Vendor Tools

How To Use A Mortgage Calculator Comparewise

What Is An Fha 203 K Loan Texas United Mortgage